2026 Fed Policy Alarm Raises Fresh Questions Over the Dollar and Fuels Crypto Market Optimism

As the U.S. Federal Reserve approaches a critical policy juncture in 2026, growing warnings about long-term dollar stability are reshaping investor sentiment across global markets. Rising fiscal deficits, heavy debt-servicing costs, and the limits of prolonged tight monetary policy are prompting concerns about the future purchasing power of the greenback. Against this backdrop, Bitcoin and the broader cryptocurrency market are emerging as potential beneficiaries of a shifting monetary landscape. Analysts suggest that even a gradual erosion of confidence in the dollar could trigger renewed demand for alternative assets, setting the stage for a possible repricing of digital currencies.

Dollar Stability Under Renewed Scrutiny

By 2026, pressure on the U.S. dollar is no longer a fringe concern. Expanding government borrowing, coupled with persistent structural deficits, has intensified debate over how long the Federal Reserve can defend currency strength without undermining economic growth. While the dollar remains the world’s primary reserve currency, investors are increasingly alert to the risks posed by sustained fiscal imbalance.

Market participants are not forecasting an abrupt collapse. Instead, the concern centers on gradual depreciation and reduced real returns, particularly if inflation remains sticky while interest rates are eventually lowered to support growth.

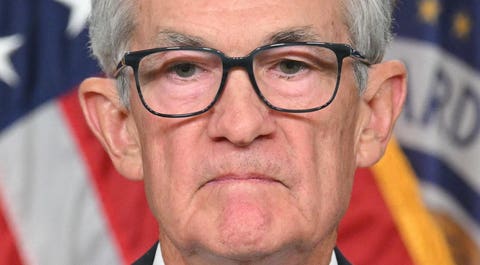

Federal Reserve at a Policy Crossroads

The Federal Reserve’s challenge lies in balancing inflation control with financial stability. Aggressive tightening has already exposed vulnerabilities in credit markets and public finances. As growth momentum cools, expectations are building that policymakers may tolerate higher inflation rather than risk a deeper slowdown.

Any shift toward accommodative policy could inject fresh liquidity into the financial system. Historically, such environments have favored assets that thrive on expanding money supply and declining confidence in fiat preservation, a dynamic closely watched by crypto investors.

Bitcoin’s Role in a Changing Monetary Order

Bitcoin’s investment thesis is being reframed amid these concerns. Its fixed supply and decentralized design offer insulation from discretionary monetary expansion, qualities that gain prominence when confidence in central banking wavers.

Rather than being viewed solely as a speculative asset, Bitcoin is increasingly discussed as a long-term hedge against currency debasement. Institutional investors, in particular, are reassessing allocation strategies, weighing Bitcoin’s volatility against its potential to protect value over extended time horizons.

Ripple Effects Across the Crypto Ecosystem

A dollar under pressure rarely affects Bitcoin in isolation. Broader crypto markets tend to benefit when liquidity conditions ease and risk appetite improves. Ethereum and other major digital assets often attract capital as investors seek exposure to blockchain infrastructure, decentralized finance, and tokenized applications.

However, analysts caution that gains may be uneven. Regulatory clarity, network utility, and balance-sheet resilience are expected to separate sustainable projects from speculative excess, especially if capital inflows accelerate rapidly.

Liquidity as the Primary Catalyst

Liquidity remains the central variable in the bullish crypto narrative. If the Fed signals rate cuts or slows balance sheet reduction, financial conditions could loosen quickly. Previous cycles suggest that such pivots often coincide with sharp rallies in digital assets, driven by leverage, derivatives activity, and renewed retail participation.

Yet liquidity-driven surges carry inherent risk. Sudden shifts in policy expectations or inflation data can reverse sentiment just as quickly, amplifying volatility across crypto markets.

A Pivotal Year Ahead

The Federal Reserve’s 2026 policy direction is shaping up as a defining test for both the dollar and digital assets. While the greenback’s dominance is unlikely to vanish, even modest declines in confidence could alter global capital flows.

For Bitcoin and cryptocurrencies, the opportunity is significant but conditional. A sustained price boom will depend not only on monetary uncertainty but also on whether adoption, regulation, and real-world utility mature alongside speculative interest. The coming year may determine whether crypto’s next rally is a fleeting response to liquidity—or a deeper shift in the global financial narrative.