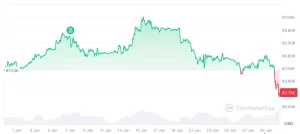

Bitcoin Slips Sharply as Crypto Markets Mirror Big Tech Sell-Off

Bitcoin’s price experienced a notable downturn this week, aligning with widespread declines in Big Tech equities, as investors reassessed risk assets amid macroeconomic pressures and shifting sentiment. The rapid fall in Bitcoin — an asset often viewed as a barometer of crypto market confidence — echoed volatility in major technology stocks, underscoring increasing correlation between digital and traditional markets. Traders pointed to concerns over tightening monetary conditions, disappointing earnings from key tech firms, and rotation into defensives as catalysts for the sell-off. Market participants are now closely watching technical support levels and macro signals for indications of stabilization or further downside pressure.

Crypto Markets Reflect Broader Risk Aversion

Bitcoin, the largest cryptocurrency by market capitalisation, saw its price retreat sharply in recent sessions, tracking declines across major technology shares. The convergence of moves in both asset classes highlights how digital assets are increasingly reacting to broader market dynamics, rather than moving independently based on crypto-specific news alone.

Investors have grown alert to potential headwinds from monetary policy shifts, inflation expectations, and investor rotation away from high-growth sectors. As headlines in global equity markets weighed on sentiment, risk assets like Bitcoin found themselves vulnerable to heightened volatility.

Technical Weakness Amplifies Downside

From a technical perspective, Bitcoin’s recent slide triggered a cascade of stop-loss orders as key support levels were breached. Traders and analysts emphasise the psychological impact of such breaks, which can exacerbate selling pressure as algorithmic strategies and short sellers enter the market.

The absence of strong upside catalysts — such as fresh institutional inflows or regulatory clarity — further limited buyers’ confidence, allowing downside forces to dominate near-term price action.

Big Tech Underperformance Adds to Risk-Off Mood

The sell-off in technology equities, a leading segment in global equity markets, contributed significantly to risk-off behaviour among investors. Weak quarterly results and cautious guidance from several technology giants sparked broader concerns about growth prospects.

Technology stocks have in recent years been viewed as proxy plays for future earnings growth, and their underperformance often triggers reassessments of valuations and risk tolerances. Crypto markets, which have historically shared narrative appeal with tech for innovation-focused investors, were not immune to this spillover effect.

Macroeconomic Indicators and Policy Signals

In recent weeks, markets have been digesting a series of economic data points suggesting persistent inflationary pressures and potential monetary policy tightening. Central bank rhetoric around interest rate pathways has at times surprised investors, reinforcing expectations that continued cost of capital elevations could weigh on growth-oriented assets.

Higher yields and a firmer currency backdrop can make fiat-denominated earnings streams relatively more attractive compared with speculative assets, including Bitcoin and other digital tokens.

Impact on Broader Crypto Sentiment

Beyond Bitcoin’s price action, the broader crypto landscape experienced volatility. Altcoins — digital tokens with smaller market caps — typically display even greater sensitivity to shifts in investor sentiment, and many registered deeper percentage falls.

Market analysts note that episodes of synchronized risk asset declines present opportunities for structural investors who prioritise long-term fundamentals, but they also caution that shorter-term traders may face persistent whipsaws as markets recalibrate.

Outlook and Key Levels to Watch

Looking ahead, market participants are monitoring critical technical thresholds for Bitcoin that could signal either stabilization or further erosion of confidence. Support levels near recent lows are being closely watched, while resistance zones above current prices may cap rally attempts until broader sentiment improves.

Analysts also emphasise that macroeconomic developments — including central bank decisions, inflation data and corporate earnings — will likely remain significant drivers of both traditional equity and crypto market trajectories in coming weeks.

Conclusion: A Market in Transition

Bitcoin’s recent price decline, in tandem with Big Tech underperformance, underscores the growing integration between digital and traditional financial markets. As macroeconomic forces and investor psychology continue to shape asset allocation decisions, cryptocurrencies may increasingly behave as components of broader risk portfolios rather than isolated, niche investments.

This evolving market dynamic suggests that participants in both crypto and equities will need to remain attuned to a wide spectrum of economic signals and policy developments, blending technical analysis with macro awareness to navigate heightened uncertainty.