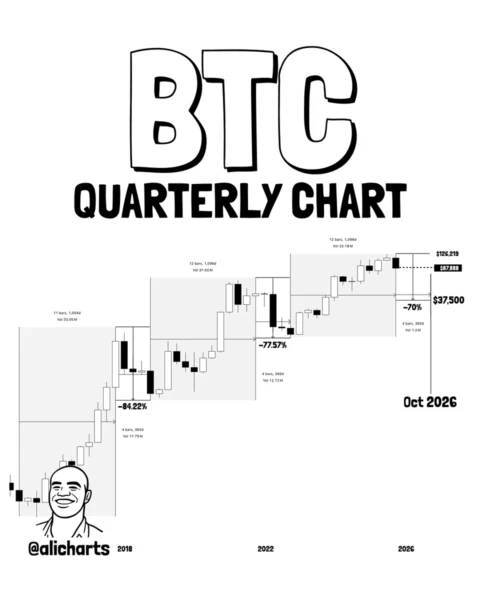

Analyst Predicts Bitcoin Bottom Around October 2026 Based on Historical Patterns

A leading cryptocurrency analyst has suggested that Bitcoin may reach its next market bottom around October 2026, citing historical price cycles and macroeconomic correlations. Analysis of previous bull and bear cycles indicates that Bitcoin often follows predictable patterns, with multiyear peaks followed by prolonged corrections. While past performance is not a guarantee of future outcomes, these patterns offer investors a framework for anticipating potential market troughs. The forecast underscores the importance of disciplined strategy, risk management, and patience for investors navigating Bitcoin’s inherent volatility. Experts caution that external factors, including regulatory developments and global economic shifts, could influence actual timing.

Historical Cycles and Bitcoin Troughs

Bitcoin has historically exhibited multiyear cycles of rapid appreciation followed by corrections. By analyzing previous peaks and troughs—such as the 2013, 2017, and 2021 cycles—analysts identify recurring durations between market tops and bottoms. These patterns suggest that late 2026 may align with the next potential bottom, offering strategic insight for long-term investors.

Influencing Factors

Macroeconomic Environment: Inflation rates, interest rate policies, and global liquidity influence investor sentiment and Bitcoin demand.

Regulatory Developments: Government policies on crypto trading, taxation, and institutional adoption may accelerate or delay price corrections.

Market Sentiment and Speculation: Retail and institutional activity continues to drive volatility, impacting the timing of bottoms.

Investment Implications

Investors are advised to:

Employ dollar-cost averaging to reduce the risk of mistimed entries.

Maintain portfolio diversification to manage exposure to volatile assets.

Monitor market indicators such as futures positioning, on-chain activity, and sentiment metrics for informed decision-making.

Outlook

While historical cycles suggest a potential Bitcoin bottom around October 2026, uncertainty remains inherent in the cryptocurrency market. Strategic patience, disciplined risk management, and proactive monitoring of market and macro factors will remain essential for investors seeking to navigate the next phase of Bitcoin’s price evolution.