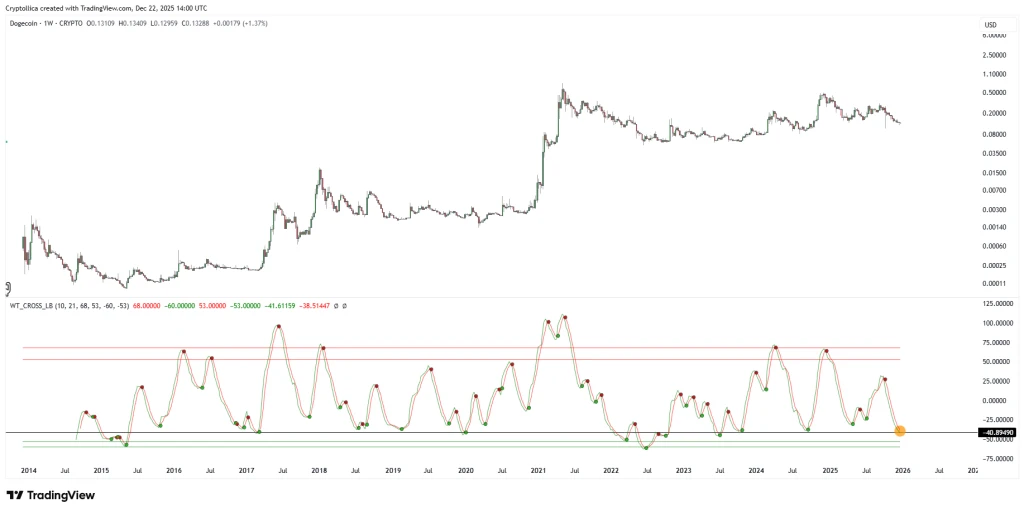

Analysts See Echoes of Dogecoin’s 2020 Accumulation Phase in Current Market Patterns

Dogecoin may be entering a familiar phase, according to market analysts who argue that current price behavior mirrors the accumulation cycle observed in 2020. The pattern is characterized by extended periods of consolidation, subdued volatility, and gradual capital buildup ahead of potential momentum shifts. While no outcome is guaranteed, the comparison has renewed debate around Dogecoin’s cyclical nature and its sensitivity to sentiment-driven inflows. Analysts caution that broader market conditions, liquidity trends, and macroeconomic factors will ultimately determine whether history repeats itself or diverges in a more mature and selective crypto environment.

Signs of a Renewed Accumulation Phase

Technical analysts studying Dogecoin’s recent price structure point to similarities with its behavior roughly five years ago. During that earlier period, DOGE traded within a narrow range for months, marked by declining volumes and limited speculative interest.

Current market data suggests a comparable setup, with price action stabilizing after prolonged corrections. Such accumulation phases are typically interpreted as periods when long-term participants gradually build positions while short-term traders exit due to lack of volatility.

Lessons From the 2020 Cycle

In 2020, Dogecoin’s accumulation phase preceded a sharp expansion in trading activity the following year, driven largely by retail enthusiasm and social momentum. While the circumstances today differ significantly, the historical parallel has attracted attention among traders seeking early signals of a potential trend shift.

Analysts emphasize, however, that the 2020 rally occurred in an environment of abundant liquidity and rising risk appetite. Replicating those conditions would require supportive macroeconomic factors that are not currently guaranteed.

Market Structure Has Evolved

Unlike 2020, the current crypto market is more institutionalized and closely tied to global financial conditions. Dogecoin now trades within a more complex ecosystem that includes regulated investment products, stricter compliance standards, and heightened regulatory scrutiny.

This evolution may dampen the magnitude of any future rally, even if accumulation patterns persist. Market participants are increasingly discerning, focusing on liquidity depth and risk management rather than purely narrative-driven trades.

Sentiment and Community Influence Remain Key

Despite structural changes, Dogecoin’s market identity remains closely linked to sentiment and community engagement. Social activity, public endorsements, and cultural relevance continue to play an outsized role in shaping short-term price movements.

Analysts note that accumulation phases often coincide with reduced public attention, a condition that historically has preceded renewed interest. Whether such interest returns at scale will depend on broader market psychology.

A Cautious Outlook for Investors

While comparisons to past cycles provide useful context, analysts stress the importance of caution. Historical patterns offer perspective, not certainty, particularly in an asset class as volatile as cryptocurrency.

For investors, the current phase may represent a period of strategic observation rather than aggressive positioning. If Dogecoin is indeed repeating its 2020 accumulation cycle, confirmation would likely come gradually, shaped by liquidity conditions, sentiment shifts, and the evolving role of meme-based assets in a more mature crypto market.