Bitcoin’s Momentum Falters as Liquidity Strains Ripple Across Crypto Markets

Crypto markets entered a cautious phase as Bitcoin’s previously resilient bullish structure showed visible signs of fatigue, weighed down by tightening liquidity across major exchanges. While the flagship digital asset avoided a sharp breakdown, indicators pointed to rising fragility beneath the surface. Inter-exchange liquidity metrics slipped into what analysts describe as a “red zone,” signaling reduced capital flow and growing hesitation among large participants. Altcoins bore the brunt of the pressure, extending losses as risk appetite thinned. Together, these signals suggest the market is transitioning from optimism to vigilance, with near-term direction hinging on liquidity recovery.

Bitcoin Holds Ground, but Cracks Begin to Show

Bitcoin continued to trade within a narrowing range, maintaining key technical levels but struggling to regain upward momentum. The asset’s price action reflected balance rather than conviction, with buyers defending support while failing to force a decisive breakout. Market participants described this phase as structural weakening rather than outright reversal, a condition often marked by lower highs and muted volume. Such behavior typically signals that bullish control is eroding, even if prices remain superficially stable.

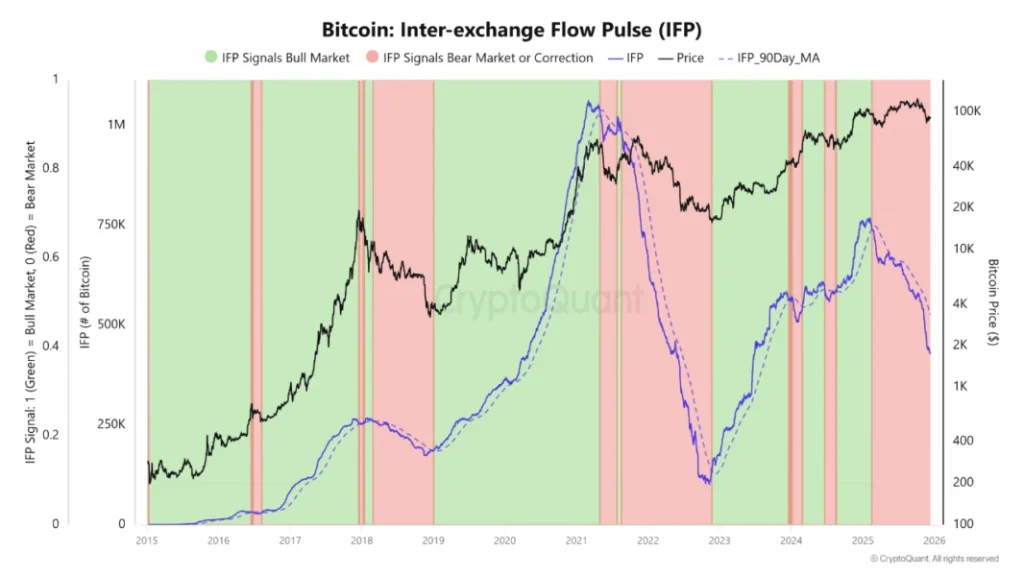

Liquidity Signals Flash Warning

A critical factor behind the shifting tone has been the decline in inter-exchange liquidity. This metric, which tracks how easily capital moves between major trading venues, fell into historically stressed territory. Reduced liquidity limits arbitrage efficiency and amplifies volatility, increasing the market’s sensitivity to large orders. When liquidity tightens simultaneously across exchanges, it often reflects institutional caution and a pullback in leverage, both of which can suppress price recovery.

Altcoins Feel the Pressure First

As is often the case during periods of uncertainty, alternative cryptocurrencies suffered deeper drawdowns than Bitcoin. Lower liquidity and thinner order books magnified selling pressure, pushing several tokens to fresh short-term lows. The divergence reinforced Bitcoin’s role as relative safe harbor within the digital asset ecosystem, while highlighting the vulnerability of speculative assets when capital retreats. This imbalance suggests risk appetite remains constrained.

Macro Sentiment and Market Psychology

Broader macroeconomic uncertainty has added another layer of complexity. With global investors reassessing risk exposure, digital assets have struggled to attract sustained inflows. Bitcoin’s inability to capitalize on previous bullish catalysts underscores a shift in psychology from accumulation to capital preservation. In such environments, markets often move sideways until a clear liquidity impulse or macro trigger resets expectations.

What Comes Next for Crypto Markets

The near-term outlook hinges on whether liquidity conditions stabilize. A rebound in inter-exchange flows could restore confidence and allow Bitcoin to rebuild its bullish structure. Conversely, prolonged stress may increase the probability of a deeper corrective phase. For now, the market appears to be in a holding pattern, balancing long-term optimism against short-term caution. Investors and traders alike are watching liquidity metrics closely, aware that in crypto, capital flow often speaks louder than price alone.