Investment research firm Bernstein has projected that Bitcoin could reach $150,000 by 2026, citing growing adoption, institutional interest, and evolving tokenization trends in financial markets. The firm also identified key companies positioned to benefit from the blockchain-driven tokenization ecosystem, including firms facilitating digital asset trading, custody, and decentralized finance (DeFi) platforms. Bernstein’s analysis emphasizes the… Continue reading Bernstein Predicts Bitcoin at $150,000 in 2026, Highlights Top Tokenization Stocks

Category: Bitcoin

Morgan Stanley Steps Up Digital Asset Strategy with Bitcoin and Solana ETF Filings

Morgan Stanley has intensified its push into digital assets by filing applications for exchange-traded funds linked to Bitcoin and Solana. The move signals growing institutional confidence in cryptocurrencies as mainstream investment instruments and reflects rising client demand for regulated exposure to digital assets. By targeting both a mature crypto asset like Bitcoin and a high-growth… Continue reading Morgan Stanley Steps Up Digital Asset Strategy with Bitcoin and Solana ETF Filings

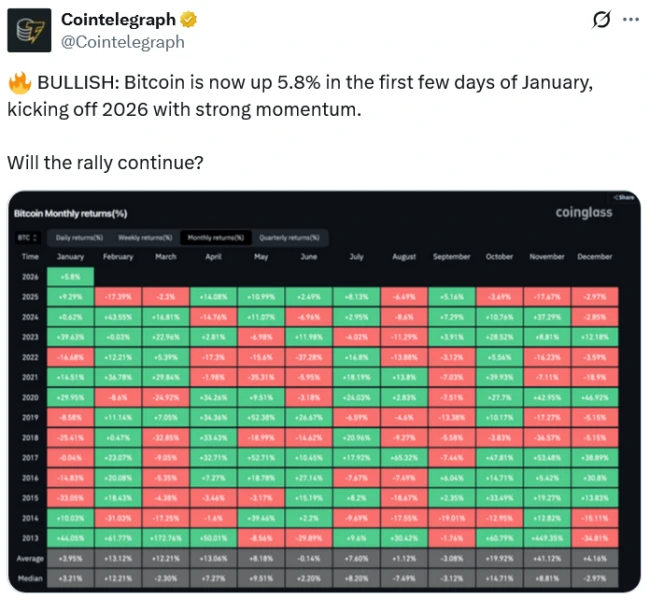

Tom Lee Predicts Fresh Bitcoin High in January, Flags Heightened Volatility Ahead in 2026

Market strategist Tom Lee has forecast a new all-time high for Bitcoin as early as January, citing improving liquidity conditions, renewed institutional interest, and growing acceptance of digital assets within mainstream finance. However, he has simultaneously cautioned investors to brace for sharper swings and elevated risk as the market moves toward 2026. Lee’s outlook reflects… Continue reading Tom Lee Predicts Fresh Bitcoin High in January, Flags Heightened Volatility Ahead in 2026

Bitcoin Giant Strategy Posts $17.44 Billion Paper Loss as Market Volatility Deepens

Strategy, one of the world’s most prominent corporate holders of Bitcoin, reported an unrealized loss of USD 17.44 billion in the fourth quarter, underscoring the scale of volatility embedded in large-scale crypto balance sheets. The disclosure reflects a sharp markdown in the value of its Bitcoin reserves amid fluctuating prices, tighter financial conditions, and heightened… Continue reading Bitcoin Giant Strategy Posts $17.44 Billion Paper Loss as Market Volatility Deepens

Bitcoin Surges Past $91,000 Amid $60 Million Short Liquidations

Bitcoin (BTC) breached the $91,000 threshold, marking one of the most dramatic price movements in recent months. The surge was fueled by a rapid liquidation of over $60 million in short positions within a single hour, underscoring heightened volatility and speculative fervor in cryptocurrency markets. Analysts attribute the spike to a combination of technical momentum,… Continue reading Bitcoin Surges Past $91,000 Amid $60 Million Short Liquidations

2026 Poised to Transform Major Cryptocurrencies: Expert Outlook on Ether, XRP, Cardano, Solana, DOGE, and SHIB

The cryptocurrency landscape is poised for a transformative year in 2026, according to market experts. Key digital assets—including Ether (ETH), XRP, Cardano (ADA), Solana (SOL), Dogecoin (DOGE), and Shiba Inu (SHIB)—are expected to experience significant developments driven by technological upgrades, regulatory clarity, and institutional adoption. Analysts anticipate that Ethereum’s scaling solutions, Solana’s network optimizations, and… Continue reading 2026 Poised to Transform Major Cryptocurrencies: Expert Outlook on Ether, XRP, Cardano, Solana, DOGE, and SHIB

Bitcoin Mining Faces Record Profitability Squeeze in 2025 Despite All-Time High Prices

Bitcoin miners in 2025 are navigating the most severe profitability squeeze on record, even as the cryptocurrency reaches unprecedented price levels. Rising operational costs, including electricity and hardware expenditures, coupled with growing network difficulty, have sharply compressed profit margins for mining operations worldwide. Analysts note that while Bitcoin’s all-time highs present potential revenue opportunities, the… Continue reading Bitcoin Mining Faces Record Profitability Squeeze in 2025 Despite All-Time High Prices

Digital Assets in Focus: Evaluating the Top Cryptocurrencies for Investment in 2026

As cryptocurrencies mature into a recognised asset class, 2026 marks a decisive phase for digital finance, shaped by regulation, institutional participation, and real-world adoption. Bitcoin and Ethereum continue to anchor the market, while a new generation of blockchain projects is redefining utility, scalability, and decentralised finance. This article examines the ten most closely watched cryptocurrencies… Continue reading Digital Assets in Focus: Evaluating the Top Cryptocurrencies for Investment in 2026

Tether Deepens Bitcoin Bet With $800 Million Addition to Reserves

Tether has strengthened its balance sheet by adding nearly $800 million worth of Bitcoin, taking its total holdings beyond 96,000 BTC. The move reinforces the stablecoin issuer’s long-term commitment to Bitcoin as a strategic reserve asset rather than a short-term trade. Coming amid heightened scrutiny of stablecoin transparency and reserve quality, the purchase signals confidence… Continue reading Tether Deepens Bitcoin Bet With $800 Million Addition to Reserves

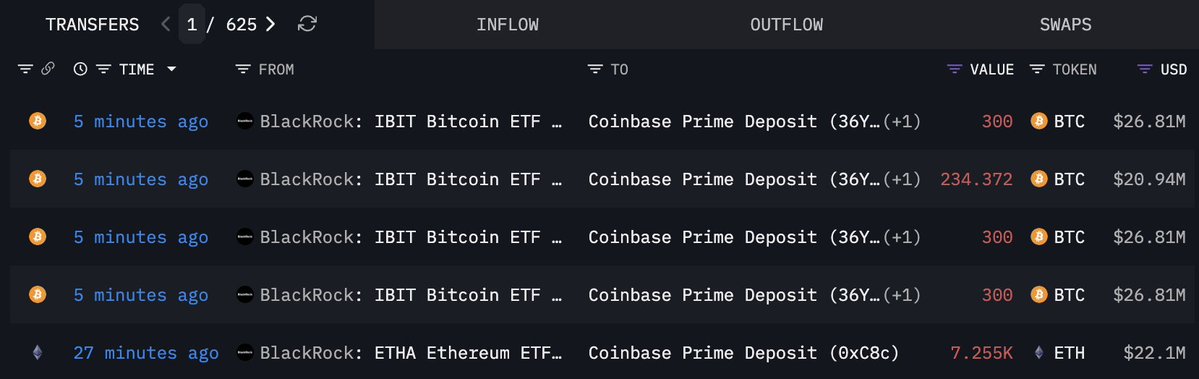

BlackRock Initiates 2026 With First-Ever Bitcoin and Ethereum Asset Sale

Global asset management giant BlackRock has made its first sale of Bitcoin and Ethereum holdings in 2026, marking a notable moment for institutional participation in digital assets. The transaction signals a shift from pure accumulation toward active portfolio management amid evolving market conditions. While the scale of the sale remains measured, it reflects a maturing… Continue reading BlackRock Initiates 2026 With First-Ever Bitcoin and Ethereum Asset Sale