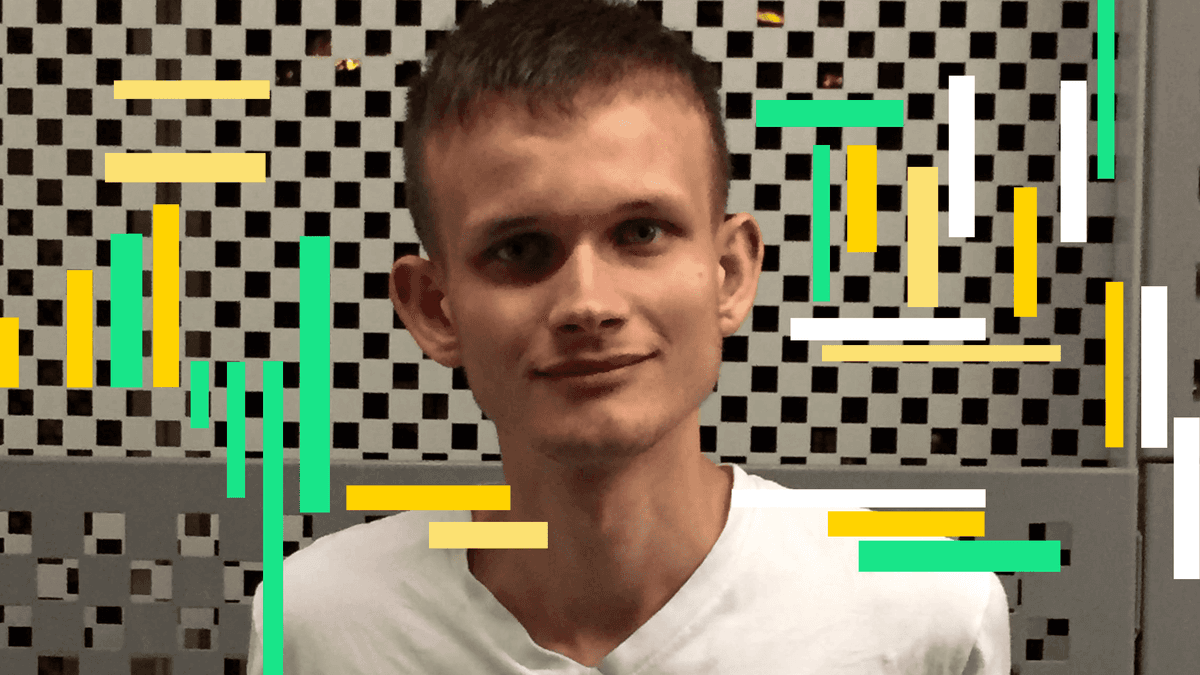

Ethereum co-founder Vitalik Buterin has reduced his ether holdings by approximately 17,000 ETH in February, transactions valued at roughly $43 million based on prevailing market prices. The sales were executed in small batches through decentralized trading infrastructure to minimize market disruption. The move comes amid a sharp 37 percent monthly decline in ether’s price, now… Continue reading Vitalik Buterin Reduces Ether Holdings as Market Slides 37%

Category: Ethereum

Ethereum’s Scaling Breakthrough Reshapes Its Economics and Validator Incentives

Ethereum’s long-standing scalability bottleneck has eased significantly following major protocol upgrades, driving transaction fees to historic lows and accelerating activity on Layer-2 networks. Gas prices have fallen to nearly 0.6 gwei, while rollups now process approximately 1.9 million transactions daily. The transformation marks a technical success, improving user affordability and developer flexibility. However, the shift… Continue reading Ethereum’s Scaling Breakthrough Reshapes Its Economics and Validator Incentives

Cryptocurrency Investment: Facts Every Investor Must Understand Before Entering the Digital Asset Market

Cryptocurrency investment has evolved from a niche technological experiment into a mainstream financial asset class attracting retail and institutional capital worldwide. Digital currencies such as Bitcoin and Ethereum have demonstrated extraordinary volatility, rapid wealth creation, and equally dramatic corrections. While blockchain technology promises decentralization and financial innovation, the market remains highly speculative, influenced by macroeconomic… Continue reading Cryptocurrency Investment: Facts Every Investor Must Understand Before Entering the Digital Asset Market

Crypto Profitability in 2026: Comparing Bitcoin, Ethereum, XRP, Solana and Dogecoin

Determining which cryptocurrency is “most profitable” at any given moment depends on timeframe, volatility, entry price and risk tolerance. Bitcoin and Ethereum remain dominant in market capitalization and institutional adoption, while Solana and XRP have gained traction through speed and cross-border payment narratives. Dogecoin continues to trade largely on sentiment and speculative momentum. Short-term profitability… Continue reading Crypto Profitability in 2026: Comparing Bitcoin, Ethereum, XRP, Solana and Dogecoin

Ethereum vs. Bitcoin: The Strategic Battle Defining the Future of Digital Finance

Bitcoin and Ethereum stand as the two most influential blockchain networks shaping the evolution of digital finance. While Bitcoin is widely regarded as digital gold and a store of value, Ethereum has positioned itself as the foundational infrastructure for decentralized applications, smart contracts and tokenized assets. Their contrasting economic models, technological architectures and institutional adoption… Continue reading Ethereum vs. Bitcoin: The Strategic Battle Defining the Future of Digital Finance

Dogecoin vs. Ethereum: Speculative Momentum or Programmable Finance Powerhouse?

Dogecoin and Ethereum occupy markedly different positions within the cryptocurrency hierarchy, reflecting divergent technological foundations and investment narratives. Dogecoin began as a satirical digital token but evolved into a widely traded asset driven by retail enthusiasm and social media momentum. Ethereum, by contrast, underpins a vast decentralized ecosystem powering smart contracts, decentralized finance and non-fungible… Continue reading Dogecoin vs. Ethereum: Speculative Momentum or Programmable Finance Powerhouse?

China and Cryptocurrency: Control, Capital and the Future of Digital Finance

China’s relationship with cryptocurrency is defined by contradiction: technological leadership in blockchain innovation alongside strict domestic restrictions on decentralized digital assets. While authorities have prohibited cryptocurrency trading and mining activities, Chinese investors and capital continue to influence global markets indirectly. At the same time, Beijing has accelerated development of its central bank digital currency, positioning… Continue reading China and Cryptocurrency: Control, Capital and the Future of Digital Finance

Global Crypto Capital: Which Nation Leads Cryptocurrency Investment in 2026?

Cryptocurrency investment has evolved from a niche technological experiment into a mainstream financial phenomenon. While digital assets such as Bitcoin and Ethereum are traded globally, identifying the single “largest investor” nation depends on measurement criteria — institutional holdings, retail adoption, mining infrastructure or sovereign participation. The United States currently leads in institutional capital allocation and… Continue reading Global Crypto Capital: Which Nation Leads Cryptocurrency Investment in 2026?

Gold or Cryptocurrency: Where Are Indian Investors Placing Their Bets in 2026?

Indian investors are increasingly weighing the relative merits of gold and cryptocurrency as vehicles for wealth preservation and capital appreciation. While gold continues to command cultural trust and portfolio stability, digital assets such as Bitcoin have captured the imagination of younger, tech-savvy participants seeking higher returns. Taxation policies, regulatory oversight, volatility dynamics and macroeconomic uncertainty… Continue reading Gold or Cryptocurrency: Where Are Indian Investors Placing Their Bets in 2026?

A Practical Guide to Investing in Cryptocurrency in India: Process, Regulation and Risk Management

Investing in cryptocurrency in India requires navigating a regulated yet evolving financial environment. Digital assets such as Bitcoin and Ethereum are legally traded but subject to strict taxation and compliance rules. Investors must select regulated exchanges, complete mandatory identity verification, understand tax liabilities and adopt secure storage practices. While technological innovation and growing adoption support… Continue reading A Practical Guide to Investing in Cryptocurrency in India: Process, Regulation and Risk Management