Crypto Titans Step In: Surge in Big-Ticket Buys on Binance Could Signal Bitcoin Upside

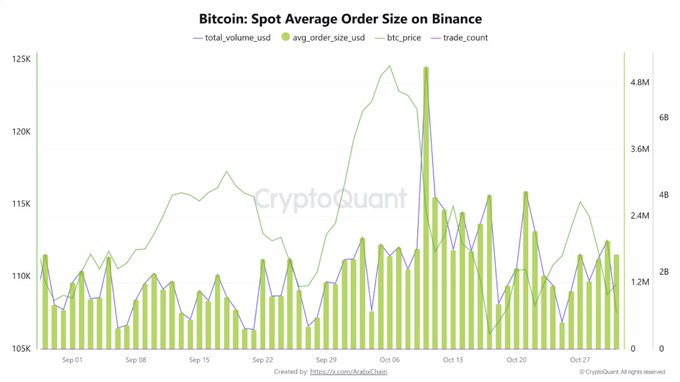

On the world’s largest cryptocurrency exchange, the average spot-order size for Bitcoin has leapt to approximately Rs. 1.60 crore (US $1.96 million), according to on-chain analytics. Institutional investors and “whales” are stepping in, interpreting the current market as a strategically opportune entry point. While this surge in large trades may hint at renewed upward momentum, it also raises broader questions about market structure, liquidity dynamics and the interplay between retail flows and large-scale accumulation. In short: the big players may be making the move, but the implications for everyday traders and long-term stability are complex.

Whale Activity Accelerates on Binance

Data gathered from the platform Binance shows that since mid-October the average US-dollar value of spot Bitcoin orders has climbed to US $1.96 million, roughly equivalent to Rs. 1.60 crore at current exchange rates. This up-tick is attributed largely to large holders—often termed whales—and institutional participants assuming dominant roles in the exchange’s spot market.

In parallel, daily spot trading volume on Binance for Bitcoin-pairs has exceeded US $2.82 billion, underscoring substantial liquidity and active engagement by sophisticated market participants.

This pattern suggests that large-scale accumulation is underway, rather than a retail-driven surge, which typically exhibits many low-value trades rather than a high average size.

Strategic Interpretation: Accumulation or Signal of Risk?

From a strategic vantage point, the increase in whale activity may signal conviction: large players believe current price levels offer favourable risk/reward. That said, it is important to dissect several dimensions:

- Accumulation phase: The concentration of large orders can reflect long-term positioning. These players may be anticipating renewed upward momentum in Bitcoin, exploiting a dip or consolidation phase to build holdings.

- Liquidity pull-forward: The deployment of large capital pieces can absorb available sell orders, driving price levels higher, yet might also reduce immediate liquidity depth, increasing volatility risk.

- Timing risk: Even though whales are stepping in, this does not guarantee a sustained breakout. Macro factors—regulation, monetary policy shifts, risk-asset sentiment—remain influential. The risk of a “whale-driven push” followed by weaker follow-through cannot be ignored.

- Market bifurcation: Heavy involvement by large players may lead to market dynamics that depart from typical retail-driven patterns, potentially making the environment more complex and less predictable for smaller traders.

Implications for Bitcoin Price and Market Sentiment

The timing is notable: the surge in large orders coincides with Bitcoin trading around the US $110 000 mark following a recent all-time high above US $126 000 in early October, and a subsequent drop to approximately US $106 000 in the wake of a sharp correction.

Whale accumulation at these levels may bolster bullish sentiment and underpin a recovery, especially if large players are confident enough to deploy capital at this stage. Yet the market may not uniformly respond. If retail participants interpret the move as a signal and initiate buying, this could create positive feedback. Conversely, if liquidity remains concentrated among a few players, price action might become more erratic.

From a sentiment standpoint, the message is clear: institutional-scale players are not sitting on the sidelines. That alone can influence narrative, attract attention, and shape media headlines—which in turn can sway broader participation.

Risks and Caveats for Market Participants

While the current activity is significant, investors—especially retail and smaller participants—should remain cognisant of several risks:

- Over-reliance on whale behaviour: Large-scale accumulation does not guarantee price appreciation; timing matters. Over-interpreting whale moves can lead to mis-timed entry.

- Liquidity risk: If large orders dominate but depth is thin elsewhere, the market may become more sensitive to large trades or sudden exits, heightening the possibility of sharp reversals.

- Regulatory & macro uncertainty: Cryptocurrency markets remain exposed to regulatory shifts, macroeconomic shocks and changes in risk appetite. Whale activity may reflect confidence in current conditions—but those conditions can change rapidly.

- Retail lag: If smaller investors react later, they might face less favourable execution or higher entry prices, reducing potential upside. Also, large players may use their scale to secure advantageous positions ahead of broader participation.

Long-Term Significance and Outlook

The presence of large-scale accumulation on Binance hints at a maturation of Bitcoin’s market landscape. As more capital flows from sophisticated holders, the asset may increasingly behave in line with institutional frameworks—liquidity, order-flow dynamics, and structural support points become more relevant.

For long-term holders, this could offer reassurance: large investors often have resources and risk-tolerance that smaller players lack, and their strategic deployments may signal conviction in Bitcoin’s longer-term trajectory. Yet the market’s evolution also means that retail players must adapt: the days of purely momentum-driven retail rallies may give way to more nuanced and layered dynamics.

Ultimately, while the surge in average order size is noteworthy and may precede upward movement, participants should continue to assess fundamentals, execution depth, and macro-environmental context. A strong accumulation base sets the stage—but performance will depend on how the broader market plays out.

In conclusion, the escalating involvement of large investors on the Binance spot market marks a potential inflection point in the Bitcoin ecosystem. It should be viewed not as a guarantee of immediate gains, but as a structural signal: the market is shifting, and the rules of engagement are becoming progressively sophisticated. For those engaged in this space, staying alert, understanding the multi-layered implications, and exercising disciplined risk management remains paramount.