Ozak AI vs. Ethereum: Assessing the 2025 ROI Potential

The cryptocurrency market in 2025 is expected to be shaped by projects that combine innovation with utility. Among them, Ethereum stands as the established leader in decentralized finance and tokenization, while Ozak AI represents a newer entrant promising to integrate artificial intelligence with blockchain. Investors are increasingly weighing the return on investment (ROI) potential of these two vastly different projects. Ethereum’s maturity, scalability upgrades, and institutional adoption give it stability and credibility, while Ozak AI’s innovative use case could offer outsized gains. The question is whether reliability or disruptive potential will define the better bet for 2025.

Ethereum’s Established Strengths

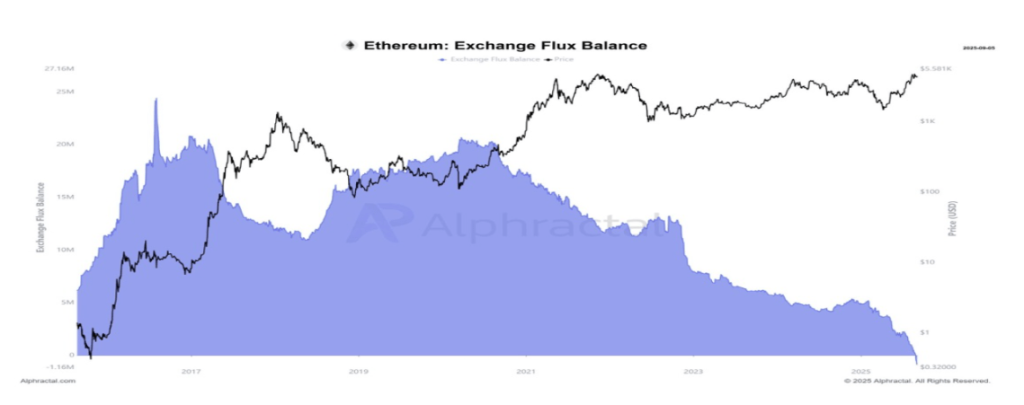

Ethereum has long been the foundation of decentralized finance, smart contracts, and tokenized assets. Its transition to proof-of-stake has reduced energy costs, improved scalability, and attracted institutional participation. The network supports thousands of decentralized applications and continues to be the preferred platform for tokenization of real-world assets, including equities and ETFs. For investors, Ethereum offers credibility, liquidity, and reduced downside risk compared with smaller projects. Its ROI potential in 2025 may not be as explosive as emerging tokens, but it carries strong fundamentals and a proven track record.

Ozak AI’s Disruptive Potential

Ozak AI enters the market with an ambitious proposition—merging artificial intelligence with blockchain ecosystems. By offering AI-driven analytics, automated decision-making, and enhanced security protocols, Ozak AI positions itself as a next-generation platform. For investors, the appeal lies in its high-growth potential and ability to capture the attention of industries exploring AI integration. However, with early-stage projects come significant risks, including limited adoption, execution challenges, and heightened volatility. While its ROI potential could surpass Ethereum’s in percentage terms, the uncertainty surrounding delivery and market acceptance makes it a speculative choice.

Risk-Reward Balance

When comparing Ethereum and Ozak AI, the distinction lies in risk appetite. Ethereum provides steady, sustainable growth backed by institutional trust and expanding real-world utility. Ozak AI, on the other hand, is speculative but carries the allure of exponential gains if its innovation achieves traction. Investors must weigh whether to prioritize reliability or pursue higher-risk, high-reward opportunities.

Broader Market Context

The year 2025 is likely to see broader adoption of tokenized assets, deeper institutional entry, and increased demand for blockchain scalability. Ethereum is positioned to benefit directly from these macro trends. Ozak AI could ride parallel waves of AI adoption, but its success depends on execution and adoption at scale. For diversified investors, exposure to both projects could provide a balanced portfolio mix of stability and growth potential.

Outlook

Ethereum offers predictability, liquidity, and resilience—attributes that appeal to risk-averse investors. Ozak AI, conversely, presents a high-risk, high-reward scenario that could either outperform expectations or underdeliver. In assessing 2025 ROI potential, Ethereum is the safer long-term asset, while Ozak AI is the speculative play for those willing to embrace volatility. The decision ultimately hinges on whether investors prefer the steady reliability of a proven leader or the disruptive allure of an emerging contender.