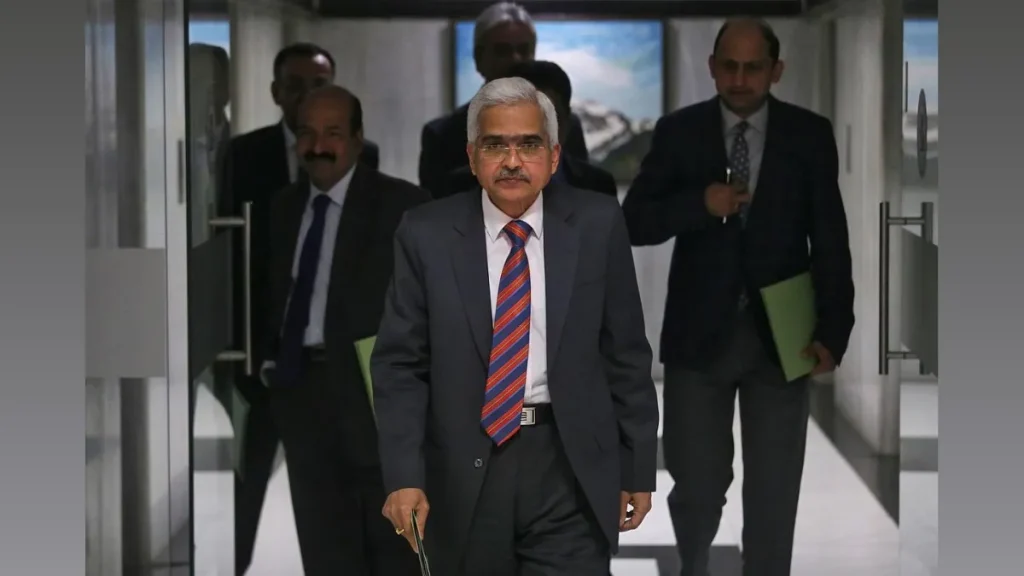

RBI Flags Cryptocurrencies as a Threat to India’s Financial Stability

The Reserve Bank of India has once again voiced firm concerns about the rapid expansion of cryptocurrencies, warning that unregulated digital assets pose material risks to the country’s financial stability. According to the central bank, crypto markets’ speculative nature, lack of intrinsic value, and vulnerability to manipulation make them unsuitable for integration into the mainstream financial system. The RBI argues that the growing retail participation in such assets could expose households to severe losses while amplifying systemic risks. Its cautionary stance underscores the need for cohesive regulatory frameworks and highlights the tensions between innovation and financial prudence.

RBI’s Renewed Warning on Cryptocurrency Risks

The Reserve Bank of India has reiterated its longstanding position that cryptocurrencies remain a destabilizing force within the broader financial ecosystem. The central bank maintains that digital tokens—most of which lack backing, cash flows, or utility—cannot be considered legitimate financial assets. With speculative trading driving the bulk of market activity, the RBI believes the sector carries inherent vulnerabilities such as extreme price volatility, fraud, and sharp corrections that could harm investors and institutions alike.

In its assessment, the unregulated nature of crypto markets creates fertile ground for market manipulation, illicit transactions, and unchecked leverage—factors that challenge the integrity of India’s financial architecture.

Concerns Over Household Exposure and Investor Protection

One of the RBI’s core apprehensions centers on the increasing participation of retail investors, many of whom are attracted by the prospect of quick gains. The central bank warns that households, particularly first-time market entrants, may underestimate the risks associated with crypto trading.

Given the absence of consumer safeguards, insurance mechanisms, or statutory protections, the RBI argues that losses incurred in these markets could have a cascading effect on personal finances and, by extension, household consumption patterns.

This shift in investor behavior raises concerns about misallocation of savings away from regulated financial products that contribute to long-term economic stability.

Systemic Threats in an Interconnected Financial Landscape

The RBI’s evaluation goes beyond individual risks and focuses on the systemic implications of widespread crypto adoption. With global markets increasingly interconnected, the central bank fears that shock events in the crypto sector could spill over into regulated markets, putting pressure on financial institutions and payment infrastructures.

The anonymity embedded in many digital assets also complicates efforts to monitor capital flows, posing challenges for law enforcement and regulatory agencies. The RBI emphasized that unchecked expansion of such instruments could undermine monetary policy, dilute capital controls, and complicate macroeconomic management.

India’s Path Toward a Balanced Regulatory Framework

While India has not imposed a blanket ban on cryptocurrencies, the central bank has consistently called for stringent oversight and clear policy direction. Its current stance reinforces the need for robust regulation that addresses financial stability, investor protection, and national security concerns.

Policymakers continue to explore options for taxation, reporting standards, and compliance frameworks, even as discussions persist about the potential role of a central bank digital currency. The RBI has expressed confidence that a sovereign digital currency—issued and backed by the state—could deliver the benefits of digital innovation without exposing the system to speculative excesses.

A Delicate Balance Between Innovation and Stability

The debate surrounding cryptocurrencies represents a broader challenge faced by central banks across the world: fostering financial innovation while preserving systemic integrity. India’s cautious approach reflects an effort to prevent emerging technologies from creating vulnerabilities within a growing and complex financial system.

As the conversation evolves, the RBI’s persistent warnings serve as a reminder that digital asset markets, in their current form, remain fraught with uncertainty. For investors and policymakers alike, navigating this landscape will require a measured and well-informed approach—anchored in prudence, transparency, and long-term economic stability.