XRP’s Quiet Accumulation Signals Potential Surge, Analysts Suggest

XRP has been quietly accumulating momentum, with market analysts highlighting a pattern of consolidation that may precede a significant price surge. Unlike previous periods of high volatility, the cryptocurrency has experienced subdued trading, suggesting strategic accumulation by investors. Analysts point to technical indicators, market sentiment, and blockchain fundamentals as potential catalysts for a forthcoming “detonation” in price. This article examines XRP’s current market behavior, evaluates the factors behind its accumulation phase, and explores what investors might expect in the short to medium term, offering insights into potential opportunities and risks in the evolving crypto landscape.

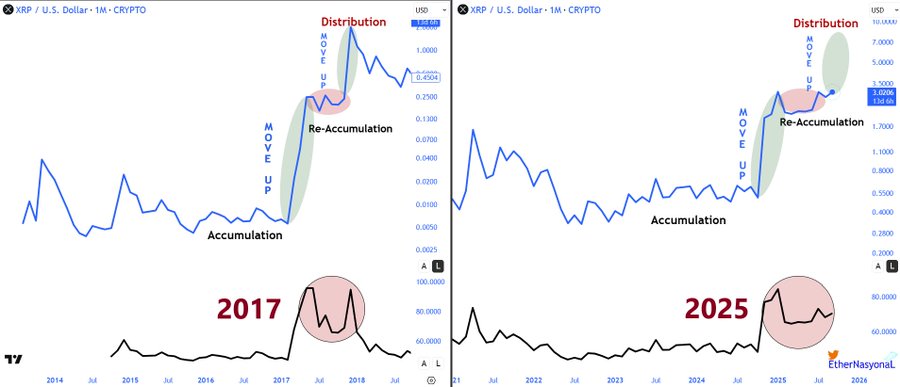

XRP’s Current Market Behavior

Over recent weeks, XRP has demonstrated low volatility relative to other major cryptocurrencies. Trading volumes remain stable but modest, hinting at accumulation rather than speculative trading. Market analysts interpret this as a signal that investors may be positioning themselves for a significant price movement once broader market conditions align.

Technical Indicators and Patterns

Several technical signals suggest potential upside for XRP:

- Consolidation Zones: Extended periods of horizontal price movement often precede breakouts.

- Support Levels: Strong demand at key price points has prevented substantial declines, indicating investor confidence.

- On-Chain Metrics: Wallet activity, transaction volume, and large holder accumulation indicate strategic positioning by influential market participants.

Analysts often view these signals collectively as early indicators of potential upward momentum.

Potential Catalysts for Growth

- Regulatory Developments: Progress in legal clarity around XRP could trigger investor confidence and market re-entry.

- Institutional Interest: Increased participation by institutional investors through regulated products may provide liquidity and stability.

- Market Sentiment: Positive trends in the broader crypto market, including Bitcoin and Ethereum, often influence XRP’s trajectory.

- Partnerships and Adoption: Expanding use cases for XRP in cross-border payments and enterprise solutions could bolster demand.

Risks to Consider

While accumulation patterns suggest potential growth, several factors warrant caution:

- Market Volatility: Cryptocurrencies remain highly sensitive to macroeconomic events and regulatory announcements.

- Speculative Behavior: Sudden sentiment shifts could trigger sharp corrections.

- Liquidity Constraints: Lower trading volumes may exacerbate price swings during periods of heightened activity.

- External Factors: Global financial uncertainty or policy changes could affect investor appetite for digital assets.

Investor Strategy

Investors considering XRP during this accumulation phase should consider:

- Monitoring Technical Levels: Identify key support and resistance zones to manage entry and exit points.

- Diversifying Exposure: Balance positions with other digital assets or traditional investments to mitigate risk.

- Setting Risk Parameters: Use stop-loss orders or position sizing to protect against sudden market reversals.

- Staying Informed: Track regulatory developments, institutional activity, and market sentiment for timely insights.

Conclusion

XRP’s silent accumulation phase may signal the potential for a significant price movement, as analysts highlight technical and on-chain indicators pointing to a forthcoming surge. While opportunities exist for investors, careful assessment of risks, market conditions, and regulatory developments remains essential. For those navigating the cryptocurrency landscape, XRP’s current behavior underscores the importance of strategic positioning, informed decision-making, and long-term perspective in an inherently volatile market.