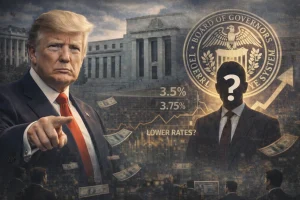

Bitcoin Declines Amid Rising Fed Chair Odds, Crypto Futures Markets React

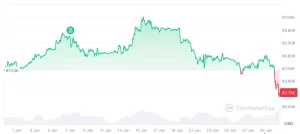

Bitcoin experienced a sharp decline as markets reacted to rising expectations that Kevin Warsh may be appointed U.S. Federal Reserve Chair, according to predictive markets Kalshi and Polymarket. Investors are increasingly factoring in the likelihood of a tighter monetary policy, which could exert downward pressure on risk assets, including cryptocurrencies. Futures and options markets responded swiftly, reflecting elevated volatility and heightened correlation between digital assets and macroeconomic developments. Analysts caution that Bitcoin’s short-term trajectory is highly sensitive to interest rate expectations, with the potential for further downside until clarity on Fed policy emerges. Risk management and strategic hedging are now critical for traders.

Bitcoin Reacts to Fed Speculation

Market sentiment shifted sharply following data from predictive trading platforms Kalshi and Polymarket, which showed increased probability of Kevin Warsh assuming the Federal Reserve Chair position. Bitcoin’s price fell in tandem with broader risk-off sentiment as investors anticipate a more hawkish policy stance, including potential interest rate hikes.

Analysts highlight that the crypto market is becoming increasingly responsive to macroeconomic indicators. Interest rate expectations influence liquidity conditions and risk appetite, driving heightened correlation between Bitcoin and equities. This marks a departure from the period when digital assets largely moved independently of traditional financial markets.

Predictive Markets Signal Tighter Monetary Policy

Kalshi and Polymarket, platforms tracking odds for political and financial events, indicate a rising probability for Warsh’s appointment. Traders are interpreting this as a signal for potentially stricter monetary conditions. Historically, expectations of tighter Fed policy have pressured high-volatility assets, including cryptocurrencies, as funding costs rise and risk-on positions become less attractive.

Crypto derivatives volumes on INR-margined platforms also spiked as traders sought to hedge positions against anticipated macro shocks. This surge underscores the increasing sophistication and integration of Indian traders into global financial sentiment flows.

Strategic Considerations for Investors

Given the heightened uncertainty, analysts recommend disciplined risk management strategies for Bitcoin investors:

Leverage Management: Avoid overexposure in margin trading to prevent amplified losses.

Hedging: Utilize options, futures, or stablecoin allocations to mitigate downside risk.

Macro Monitoring: Track Fed announcements, policy signals, and equity market movements for informed trading decisions.

Experts stress that while short-term volatility is elevated, long-term fundamentals of Bitcoin remain intact for investors with diversified portfolios and clear risk parameters.

Implications for Crypto Market Maturity

The market’s reaction demonstrates that cryptocurrencies are increasingly sensitive to traditional macroeconomic factors. Predictive platforms like Kalshi and Polymarket now serve as real-time barometers of policy sentiment, influencing not only institutional investors but also retail participation in digital assets.

This development reflects the maturation of crypto markets, where price discovery is linked closely to global policy expectations, liquidity conditions, and macroeconomic cycles rather than purely speculative demand.

Conclusion

Bitcoin’s recent decline amid rising Kevin Warsh Fed Chair odds illustrates the growing intersection of cryptocurrency markets with traditional macroeconomic signals. As interest rate expectations shape investor behavior, digital assets exhibit amplified short-term volatility. Traders and portfolio managers are urged to adopt proactive hedging and risk management strategies while monitoring predictive market indicators closely. The episode highlights both the opportunities and risks inherent in a crypto market that is increasingly entwined with global economic dynamics, marking a pivotal stage in its evolution as an asset class.