Bitcoin Set for Continued Volatility Amid Stock Market Downturn, Analysts Warn

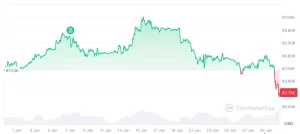

Bitcoin’s price trajectory is entering a turbulent phase, with analysts warning of continued declines in tandem with a broader market slump. Following recent losses in technology equities, cryptocurrency markets are exhibiting heightened correlation with traditional financial assets, signaling intensified systemic risk. Experts highlight that Bitcoin’s cyclical behavior — historically characterized by amplified swings following bull runs — suggests sustained downward pressure until market stabilization. Investors are advised to recalibrate portfolios, employ risk management strategies, and consider long-term hedging options. The digital asset’s performance now increasingly mirrors macroeconomic shifts, underlining the interplay between crypto markets and global equity trends.

Bitcoin Mirrors Tech Stocks in Current Cycle

Recent market data shows that Bitcoin is closely tracking the movements of major technology indices. Analysts attribute this to increased institutional participation in digital assets, which has aligned crypto price dynamics with broader equity market cycles. As tech stocks experience corrections due to valuations, interest rate concerns, and global macroeconomic pressures, Bitcoin is similarly experiencing accelerated downside volatility.

Market observers note that these correlations are stronger during periods of financial stress, indicating that Bitcoin is no longer a fully independent asset class but is subject to the same liquidity and sentiment dynamics affecting equities.

Cyclical Dynamics and Historical Precedents

Cryptocurrency analysts point to Bitcoin’s historical cycles, where sharp corrections often follow prolonged periods of rapid gains. Such cycles are compounded by investor sentiment, leverage in futures markets, and regulatory developments.

Past trends suggest that Bitcoin’s price may continue to “bleed” until the market absorbs excess speculative positioning, similar to prior bear phases post-bull rallies. Traders are increasingly cautious, monitoring macroeconomic indicators such as U.S. Federal Reserve policy, inflation data, and global tech sector performance to anticipate potential market inflection points.

Risk Management and Investor Guidance

Experts recommend heightened risk management measures during this phase of market turbulence:

Portfolio Diversification: Reducing exposure to highly correlated assets can mitigate systemic risk.

Stop-Loss Strategies: Leveraging automated mechanisms in derivatives markets can prevent large losses.

Hedging: Utilizing options, inverse ETFs, or stablecoin positions to offset potential downside.

Analysts emphasize that while Bitcoin remains a high-risk asset, careful strategy implementation can preserve capital during cyclical drawdowns while positioning for eventual recovery.

Macro Implications for Cryptocurrency Markets

The current Bitcoin downturn underscores the growing integration of cryptocurrency into global financial systems. Rather than acting solely as an independent “digital gold,” Bitcoin now responds to macroeconomic signals and liquidity trends impacting the broader financial landscape. This integration offers both opportunities for strategic investors and cautionary lessons for retail participants unaccustomed to cross-asset market dynamics.

Conclusion

Bitcoin’s present trajectory reflects both cyclical market behavior and its evolving correlation with global equities, particularly technology stocks. While near-term price action remains uncertain, informed investors can navigate this volatility through disciplined risk management and strategic hedging. The digital asset’s performance highlights the maturing nature of crypto markets and their increasing susceptibility to broader economic and market cycles, emphasizing the importance of prudence in portfolio construction.