Dogecoin at a Crossroads: Why Analysts See a Potential Slide Toward $0.08

Dogecoin, the meme-inspired cryptocurrency that once captured global investor enthusiasm, is again under scrutiny as market analysts warn of a possible decline toward the $0.08 level. Weak price momentum, declining trading volumes, and broader risk-off sentiment across digital assets are weighing heavily on the token. Technical indicators suggest Dogecoin is struggling to hold key support zones, while macroeconomic uncertainty and shifting investor preferences toward fundamentally stronger projects add further pressure. Although the asset retains a loyal community and occasional speculative spikes, current market dynamics indicate that downside risks may dominate in the near term.

Market Context: A Fragile Crypto Environment

The broader cryptocurrency market remains volatile, shaped by tightening global liquidity, cautious investor sentiment, and uneven capital inflows. Bitcoin and Ethereum, often seen as bellwethers, have shown limited upside conviction, creating a challenging environment for high-beta assets like Dogecoin. In such phases, speculative tokens with limited utility tend to underperform as investors prioritize capital preservation over aggressive risk-taking.

Dogecoin’s price action reflects this broader mood, with rallies being met by swift profit-taking rather than sustained accumulation.

Technical Signals Point to Downside Risk

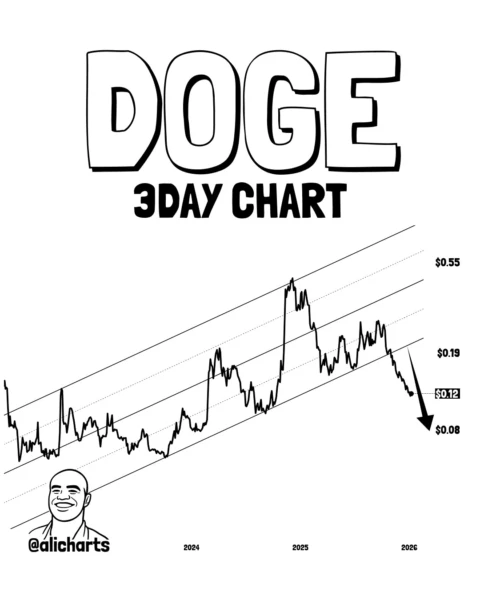

From a technical perspective, analysts highlight several warning signs. Dogecoin has reportedly slipped below important moving averages, indicating a weakening trend. Momentum indicators, such as the Relative Strength Index (RSI), suggest the asset is neither oversold nor showing signs of a strong rebound, leaving room for further downside.

More critically, the failure to reclaim previous resistance levels has turned those zones into overhead supply. If current support levels fail to hold, analysts believe a gradual move toward the Rs. equivalent of $0.08 could materialize, driven by stop-loss triggers and diminishing buyer interest.

Volume and Sentiment: Fading Speculative Energy

Trading volume, a key indicator of market conviction, has shown a noticeable decline in recent sessions. Lower volumes often signal reduced participation from both retail traders and short-term speculators—groups that historically fueled Dogecoin’s sharp rallies.

Sentiment indicators across social and derivatives markets also point to cooling enthusiasm. While Dogecoin continues to command attention due to its cultural legacy, attention alone has not translated into sustained buying pressure in the current cycle.

Fundamental Limitations and Competitive Pressure

Unlike newer blockchain projects emphasizing scalability, decentralized finance, or real-world utility, Dogecoin’s fundamentals remain relatively unchanged. Its value proposition is largely narrative-driven, making it particularly vulnerable during periods when markets reward utility and innovation over sentiment.

As capital rotates into projects with clearer revenue models or institutional backing, Dogecoin faces increasing competition for investor attention and liquidity.

What Could Change the Outlook?

Despite near-term bearish projections, Dogecoin is not without catalysts. A broader crypto market recovery, renewed retail speculation, or high-profile endorsements could quickly alter price dynamics. Historically, the asset has demonstrated an ability to defy conventional valuation models during periods of heightened enthusiasm.

However, absent such triggers, analysts caution that patience may be tested, with downside consolidation remaining a plausible scenario.

Conclusion: Caution Dominates the Near-Term View

While Dogecoin’s long-term cultural significance within the crypto ecosystem is undeniable, current market signals suggest caution. Technical weakness, declining volume, and an unforgiving macro backdrop support the view that a move toward $0.08 cannot be ruled out. For investors, the coming weeks may prove critical in determining whether Dogecoin stabilizes—or continues its gradual descent in a market increasingly driven by fundamentals rather than hype.