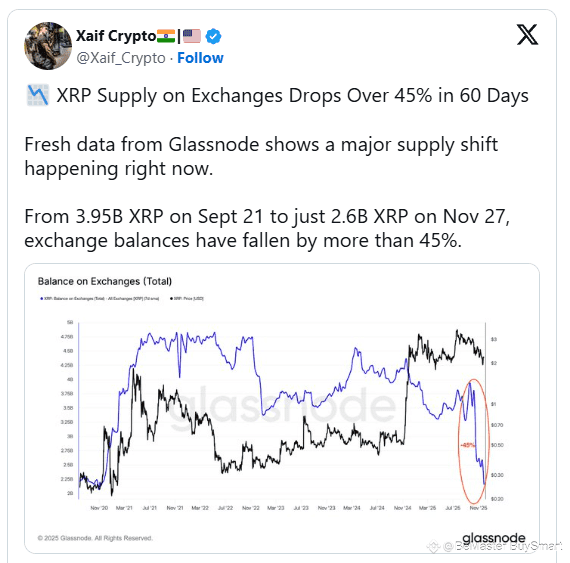

XRP Supply Plummets on Exchanges, Signaling Potential Market Shift

XRP has experienced a significant reduction in circulating supply on major cryptocurrency exchanges, sparking speculation about market dynamics and price potential. Analysts attribute the decline to increased off-exchange storage by long-term holders, strategic withdrawals by institutional investors, and anticipation of upcoming network developments. Reduced exchange liquidity may amplify price volatility, as smaller trading volumes can lead to sharper market movements. Market observers suggest that this trend could signal bullish sentiment, with holders opting for private wallets rather than active trading. The move underscores evolving investor strategies and highlights the growing influence of supply dynamics on XRP’s short-term and long-term performance.

Exchange Outflows and Their Implications

The recent surge in XRP withdrawals from exchanges represents a notable shift in market behavior. Large-scale transfers to private wallets indicate that investors are holding rather than trading, potentially reducing selling pressure in the near term.

Analysts argue that this trend could create a supply-demand imbalance, making XRP more susceptible to rapid price movements if market sentiment shifts positively. Exchange liquidity metrics show the most pronounced outflows in the past six months, highlighting a trend toward accumulation.

Drivers Behind the Exodus

Several factors are driving the mass withdrawal of XRP from exchanges:

- Long-Term Holder Accumulation: Retail and institutional investors increasingly prefer cold storage to safeguard assets.

- Institutional Positioning: Strategic moves by large holders can indicate confidence in future network developments or partnerships.

- Speculation on Upcoming Catalysts: Market participants are anticipating regulatory clarity, protocol upgrades, or ecosystem growth that may positively impact XRP value.

These dynamics collectively signal that a significant portion of XRP is moving out of active circulation, which could influence market pricing.

Impact on Market Volatility

Lower exchange liquidity can heighten price volatility. With fewer tokens available for active trading, even modest buy or sell orders may trigger disproportionate price swings.

Technical analysts note that reduced supply on exchanges often precedes sharp upward or downward movements, emphasizing the importance of monitoring order book depth and trading volume for XRP.

Investor Sentiment and Strategic Considerations

Investor sentiment appears increasingly bullish, as evidenced by the preference for off-exchange storage. Market participants are signaling confidence in long-term value, prioritizing security and accumulation over immediate liquidity.

Experts advise traders to remain attentive to macro crypto trends, regulatory announcements, and XRP-specific developments, as these factors will heavily influence the next phase of price action.

Conclusion

The dramatic reduction of XRP supply on exchanges represents a pivotal moment for the cryptocurrency, with potential implications for liquidity, volatility, and price direction. As long-term holders consolidate positions and speculative activity shifts, the market may experience amplified movements. For investors, understanding the interplay between exchange supply and broader market dynamics is crucial for anticipating trends and navigating XRP’s evolving landscape.